The End of the Bull

Being prepared is not just something we say. It is something we live by. We have been talking about a slowdown in the economy and a possible recession for over a year. We have drawn on the whiteboard, showed slides on our TV, and have done our best to educate on the current economic cycle. The bull market that started in 2009 came to an end today. The Dow has dropped 20% since its February highs.

My team has communicated the moves we have made in the portfolios, and future moves we will make. Your portfolio is prepared for this. It the most balanced and conservative it has been in years. We have done an excellent job vetting and extensively researching the money managers in your portfolio. We feel confident in their ability to navigate the current market conditions.

We are not market timers; however, we are tactical. There is a difference between being a market timer and being a tactical investor. The difference is basing investment decisions on known data vs. emotion and speculation. We pay very close attention to the data. Corporate health and economic data are significant drivers of our investment decisions and strategy.

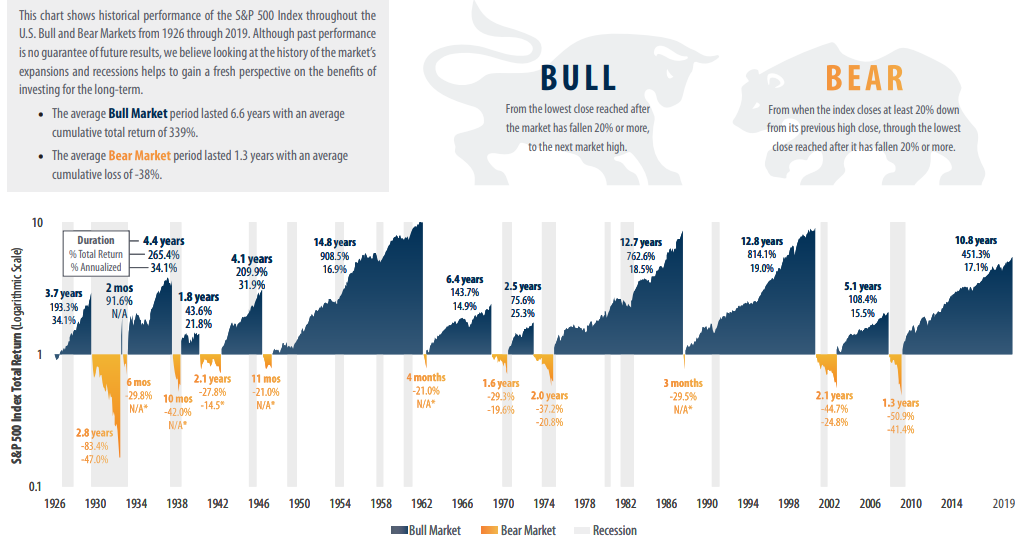

I know as investors, we don’t like negative returns; however, I wanted to provide some perspective. The above graph from First Trust illustrates why it’s so important to stay invested and that while turbulent times seem severe and sudden, they often fade away just as fast. As you can see, “Bear” markets historically happen fast, but they last much, much shorter than Bull markets do. Every Bear market has provided opportunities for the patient investor.

The downside protection in the portfolio is working. We will continue to share with you your portfolio vs. your benchmark we use inside your plan.

Bull markets don’t last forever and bear markets historically don’t last very long. This market gave us 11 good but challenging years. We will persevere through this new bear market.

We will continue to communicate, and we are always here when you have questions or concerns.

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. Past performance does not guarantee future results. Investing involves risk and investors may incur a profit or a loss.