Fee-Only Financial Planning

Aspen Wealth Strategies was born out of a strong desire to break down the walls of exclusivity that are common in the world of financial planning and wealth management offices. We believe that regardless of resources or asset size, everyone deserves to be treated with respect, thoughtfulness, and provided with the absolute best client experience possible. As our name implies, we are firmly rooted in relationships and that is at the forefront of everything we do and we always operate with integrity and your success in mind.

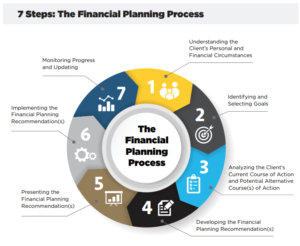

If you’re interested in a financial planning partner who will tailor a plan specifically to you and with you, we would love to have a conversation and get to know you better. We closely follow the CFP Boards Guidelines for financial planning, in both our process and the way in which we interact with our clients.

Our Process

- Establish the relationships and identify needs and objectives

- Gather relevant information

- Analyze the financial situation

- Develop specific recommendations and a plan of action

- Implement the appropriate strategies

- Monitor the plan for any changes