Archive for April, 2019

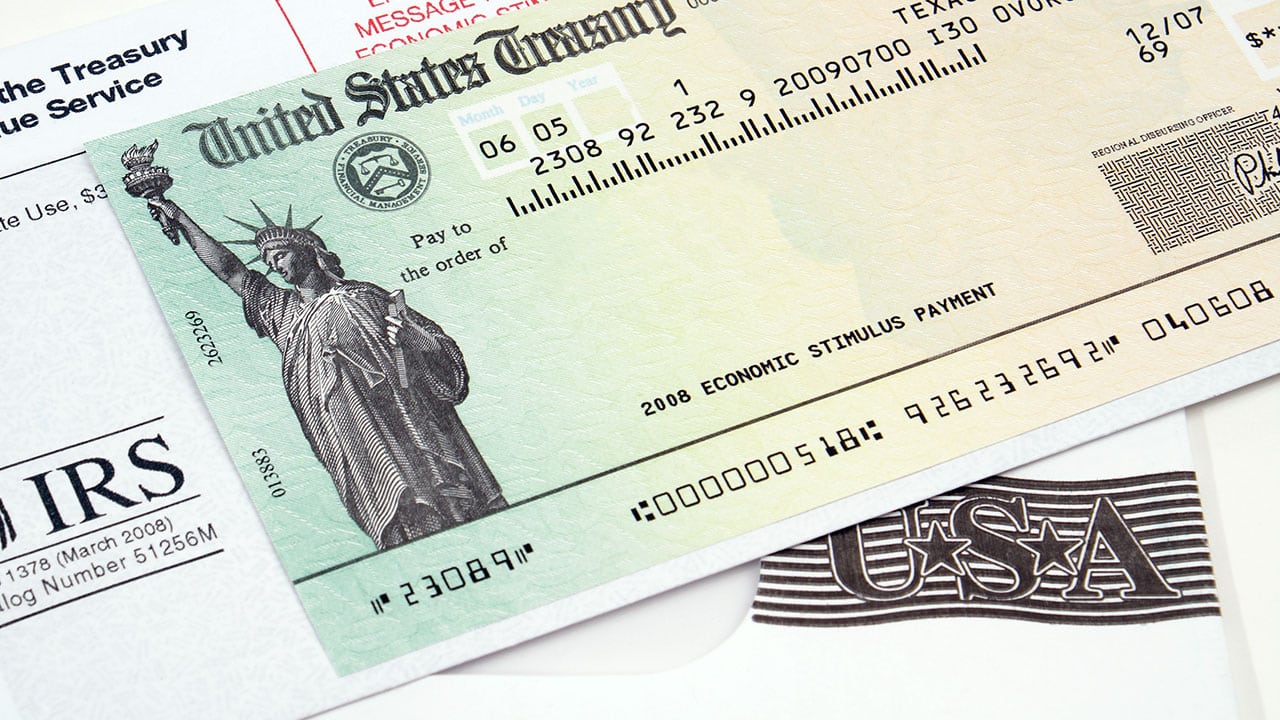

Ideas for Your Tax Refund

Tax filing season is never fun, but for many Americans, the silver lining is the refund they’ll receive when it’s over. If you’re one of the individuals who received, or expect to receive, money back from Uncle Sam this year, here are a few ideas for putting those funds to good use. Pad your emergency reserve | A general rule of thumb is to keep at least 3-6 months’ worth of expenses in liquid assets to protect against unforeseen circumstances (i.e., job loss, short-term disability, unexpected car or home expense, etc.). This fund may consist of checking/savings accounts, money market funds, or short-term CDs. Pay down debts | Whether it’s a vehicle loan or credit card, the interest rates on these accounts essentially act as a negative return on investment. That’s why it’s important to pay off high-interest debt as soon as feasible, assuming there aren’t any pre-payment penalties. Fund…

[ajax_load_more post_type="post" year="2019" month="4" offset="5" button_label="Load More" pause="true"]