2021 Tax Outlook

With 2020 behind us, we wanted to give you a brief update on what you might be able to expect for the 2021 tax year.

While we believe there’s a very good chance to see updated tax legislation passed under the new administration, we do not foresee those changes occurring in 2021. That being said, if (and as) any major changes occur to the tax code, we’ll be here to keep you updated.

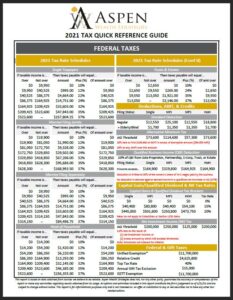

Several Inflation Adjustments to…

- Personal tax brackets

- Trust tax brackets

- Standard deduction

- Retirement plan contributions

- Health Savings Plan contributions

- Deduction phaseouts

- Contribution limits

- Estate & gift tax exemption

- Capital gain brackets

- Qualified business income (QBI) thresholds

- Social Security OASDI tax limit

Click here for a handy 2021 tax “Quick Reference Guide” that covers all of the above and more!

RMDs Are Back

While the IRS hit the pause button on RMDs last year via the CARES Act (due to the coronavirus pandemic) no such hiatus will exist in 2021.

As always, if you have any questions, please reach out to us at 303-421-1113 or at info@aspenwealthstrategies.com!

Aspen Wealth Strategies does not, nor any other party, guarantee the accuracy or completeness of this report or make any warranties regarding results obtained from its usage. This report is for informational purposes only and is not intended as an offer or solicitation to buy or sell securities nor to take any other tax-related actions. Please consult your tax professional for advice related to any matters discussed herein.