Aspen Wealth Strategies Q3 Market Commentary

“It’s the end of the world as we know it…and I feel fine”

- R.E.M. (1997) – American Alternative/Indie band

“It’s the end of the world as we know it…”

Many of you may best remember this song from the opening scene of the first “Independence Day” movie – you know, right before the alien horde destroyed most of the planet. The ironical foreshadowing set the tone for the eventual end of the film as the human race triumphed over the alien evil and everyone was left “feeling fine”.

I feel like the financial media has been playing this song on their Pandora/Spotify/iPhone on repeat for the last several months. We have all seen the headlines and news regarding tariffs, and truth be told, regardless of the long-term success or failure of these tariffs – in the short-term – markets hate the uncertainty. I recently spoke with a fellow I went to graduate school with and he mentioned to me that his company just stopped a rather large development here in the US and laid off 1,200 workers – all due to the tariffs. I have no reason to not believe him, and he is in a position to know these things, but this is an example of the possible unintended short-term consequences that uncertainty brings to the market.

In a recent rally in North Dakota, President Trump remarked that “[The] trade disputes will ultimately be worked out.” I have a feeling that this will happen later this summer, just in time for all of us to be inundated with political commercials in the run up to the November elections. What happens between now and then is anybody’s guess, and as I have always said – I do not care about politics when it comes to your portfolios. What I do care about how policies affect asset prices, and right now the uncertainty surrounding trade policy is keeping a lid on what should be, in my opinion, a solid year for stock returns.

“…and I feel fine.”

Let’s take a look at some key data:

- The unemployment rate is down to 3.8%

- Wage growth, while still not at an optimum level, are up 2.7% from one year ago – this is higher than the current inflation rate

- Both manufacturing and non-manufacturing indexes as measured by the ISM (Institute for Supply Management) are solidly growing

- New home sales are at their second-highest level since 2007

- Housing starts are at their highest levels since 2007

Source: First Trust

Ladies and Gentlemen, these are not the statistics of a slowing economy. Here are some other key points:

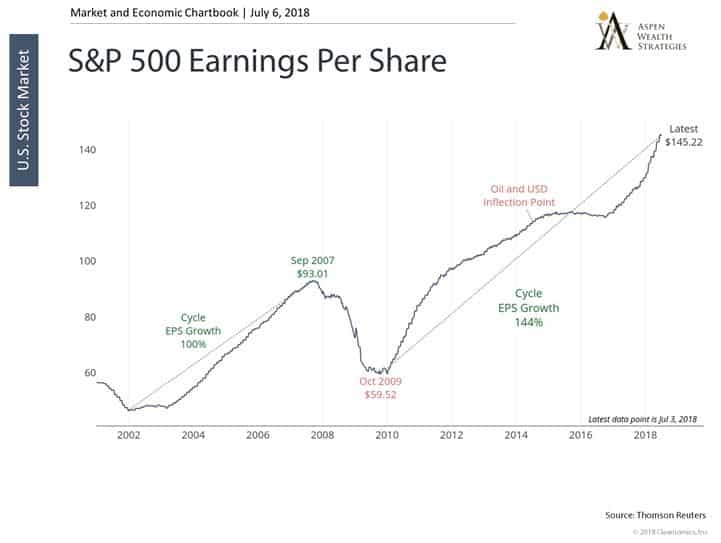

Earnings per share of firms in the S&P 500 continue to grow. Eventually earnings will peak and start to revert to a more normal level, but we are not seeing signs of that yet.

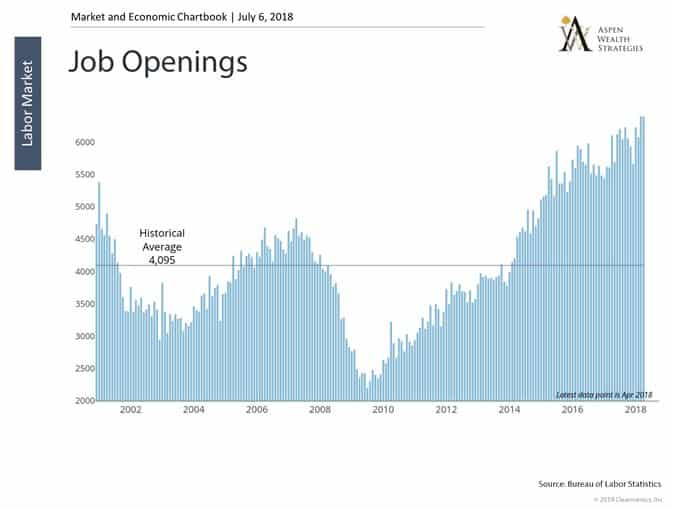

There are a record number of job openings in the US – we are actually at risk of running out of workers. Once this happens, the economy may begin to slow.

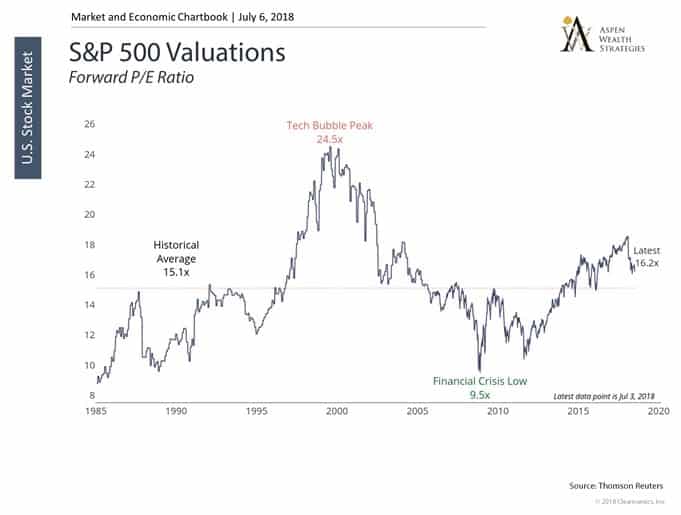

Forward looking valuations are actually starting to come down. Not because of a pullback in stock prices, but due to earnings (E) increasing faster than stock prices (P).

Some of you may remember a talk I gave last year when I said that we could be entering an “earnings driven market”. We are there, and this is what it looks like.

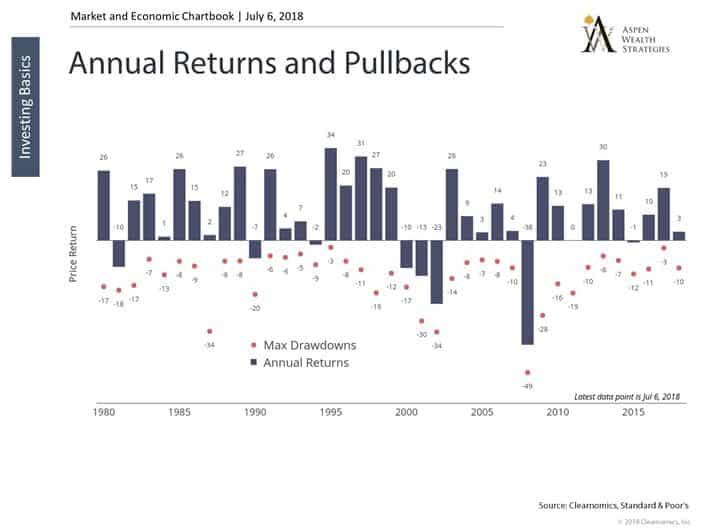

We have already seen a”normal”pullback in 2018. That doesn’t mean we won’t see another, but remember that these”corrections”are normal, even in”up”years in the S&P 500.

“Chaos in inherent is all compounded things. Strive on with diligence.”

- Buddha

So where does all this leave us?

Year-to-date as of 6/30/2018 markets have been, well, chaotic. Returns have essentially a been mixed bag, with the Dow Jones Industrial Average slightly down, the S&P 500 slightly up, International markets slightly down, and bonds down. The bright spots have been technology and small caps – both of which most of our allocations, even the “Conservative” ones, are slightly larger than they have been historically.

We expect more of the same in the coming quarter. Many of the gains we are seeing in earnings are coming from technology, and many of the revenue gains are coming from small-cap stocks. Small-cap stocks also generally do not trade internationally so they are less affected by all of the tariff talk.

A full-blown and protracted trade war would likely, in my opinion, lead to a recession. Given the data we have today, I do not believe these tariffs will last beyond the current election cycle – there is simply too much political capital on the line for this to be a long, drawn-out “war”. Earnings this quarter may be a ballast to otherwise “bad” news on the trade front and I believe that there are still plenty of pockets of opportunity for returns in these markets, mainly in Technology and Healthcare. These sectors can be volatile and can become overbought, respectively, so we do try to limit them to some extend in your portfolios especially when they appear expensive.

In summary, despite the volatility brought on by the threat, or even implementation of a “trade war”, as long as the turbulence is short-lived the economy should be just fine. Diligence when it comes to investing involves rebalancing discipline, sometimes ignoring fear, and knowing when to not be greedy with markets. If you recall, many investors got greedy in the Spring of 2000 when the “tech bubble” started to pop. Others were fearful in March of 2009 when markets bottomed and sold when they should have bought.

There are certain inalienable truths to investing in my opinion, and one of them is earnings – if you have no earnings or your earnings are in decline, you are in trouble. However, if you have earnings and they are growing along with your revenue, you will probably be OK. No matter what’s happening with the economy, I believe these truths pass the test of time.

Joel P. Faircloth, MBA

Chief Financial Officer, Aspen Wealth Strategies

Wealth Advisor, RJFS