CARES Act – Details for Individuals & Families

On Friday, March 27, 2020, the CARES Act was signed into law to provide relief to individuals and businesses impacted by COVID-19. Below are some of individual taxpayer-focused provisions of the CARES Act.

Recovery Rebates (i.e. stimulus checks)

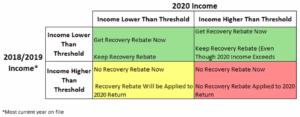

- Considered as a refundable tax credit for 2020

- $1,200 for individuals; $2,400 for married (additional $500/child for children under 17)

- Will phase out at $5 per $100 of additional income over the following Adjusted Gross Income (AGI) limits:

- $75,000 single

- $150,000 married

- Based on 2019 tax return if filed, otherwise 20181

- How will it be paid?

- Social Security recipients will receive theirs when they get their typical checks

- Non-Social Security recipients will have it deposited where they received their 2018/2019 fund

- Otherwise, the IRS will send it to the last known address on file (Form 8822 to change address with IRS)

Coronavirus-Related Distributions from Retirement Accounts

- Up to $100,000 from (combination of) IRAs or employer plans

- Must be made in 2020

- Eligibility:

- Taxpayer, spouse, or dependent was diagnosed with COVID-19; or

- Experienced adverse financial consequences as a result of being quarantined, furloughed, laid off, or having work hours reduced; or

- Unable to work due to lack of childcare as a result of the disease; or

- Own(ed) a business that closed or operated under reduced hours because of the disease

- Benefits:

- Exempt from 10% early withdrawal penalty typically applicable to pre-59 ½ distributions

- Not subject to mandatory withholding from employer plans2

- Eligible to be repaid over 3 years

- Essentially treated as a lengthy rollover & can be paid back at one time or spread it out

- Still taxable but income may be spread over 3 years

Enhancements to Loans from Employer Plans

- Maximum loans from company plans have increased to $100,000 (from $50,000)

- 100% of vested balance may be used

- Payment(s) otherwise owed may be delayed by one year

Required Minimum Distributions (RMDs) Waived in 2020

- Includes IRAs (even inherited/beneficiary IRAs) and employer retirement plans (401k, 403b, 457b, etc.)

- If you already took your RMD for the year, you have the following options:

- 60-day rollover (if applicable) and haven’t already rolled this year (due to the once-per-year rule)

- If above isn’t an option, roll it back over as a Coronavirus-Related Distribution3 if possible

- Unfortunately, there is no option to roll back beneficiary RMDs from inherited accounts

- 60-day rollover (if applicable) and haven’t already rolled this year (due to the once-per-year rule)

New “Above-the-Line” Charitable Deduction

- Applies to taxpayers that do not itemize

- Limited to $300

- Must be made in cash, no appreciated securities

- Must go directly to 501(c)(3) charity; no Donor Advised Funds

Expanded Itemized Charitable Deduction

- AGI limit for charitable contributions temporarily repealed; effectively increases AGI limit to 100% of AGI

- Must be made in cash, no appreciated securities

- Must go directly to 501(c)(3) charity; no Donor Advised Funds

Unemployment Compensation: Expanded

- Pandemic Unemployment Insurance: unemployment compensation for those who don’t qualify for anything else

- Elimination of waiting period: federal government will cover first week of unemployment

- Bonus check: Regular state unemployment benefits bumped by $600/week4 for up to 4 months

- Extension of Benefits: 13 extra weeks of unemployment insurance

- Incentives to create short-term compensation programs: essentially a way to avoid laying someone off; if you can find a way to retain and pay an employee (even at reduced income/hours) government may pay up to 50%

Resources

Footnotes

1 Someone could have had a great year in 2018/2019 but have been furloughed/laid off and now do need it but won’t receive it. That being said, they’ll be indemnified when they file their 2020 taxes but, unfortunately, that may come too late for some. And it doesn’t work in reverse – if someone had low income in 2018/2019 but are making a lot of money now, they get to keep their stimulus money.

2 Employees can “self-certify” that they need the funds for this purpose; employers cannot require proof.

3 Eligibility:

- Taxpayer, spouse, or dependent was diagnosed with COVID-19; or

- Experienced adverse financial consequences as a result of being quarantined, furloughed, laid off, or having work hours reduced; or

- Unable to work due to lack of childcare as a result of the disease; or

- Own(ed) a business that closed or operated under reduced hours because of the disease

4 Typical unemployment check is $380 per week