CARES Act – Details for Small Businesses

On Friday, March 27, 2020, the CARES Act was signed into law to provide relief to individuals and businesses impacted by COVID-19. Below are some of small business-focused provisions of the CARES Act, including details and application instructions. Furthermore, we have also included information on the Small Business Administration’s Economic Industry Disaster Loan Program for those who may benefit.

Paycheck Protection Program (“PPP”)

Details

- Loans can be up to $10 million

- 10-year maximum duration

- Must apply by June 30, 2020

- Discharged debt considered non-taxable

- Maximum interest rate of 4%

- Initial payments will be deferred for 6 to 12 months (exact months TBD)

Eligibility

- 501(c)(3) nonprofits, sole-proprietors, independent contractors

- Less than 500 employees (or employee size standard under NAICS Code)

- The package requires eligible borrowers to make a good faith certification that the loan is necessary due to the uncertainty of current economic conditions caused by COVID-19

Proceeds to be used for…

- Payroll costs

- Group health insurance premiums & other healthcare costs

- Salaries and/or commissions

- Rent or mortgage interest

- Utilities

Portion of loan may be forgivable

- Equal to amounts spent on the below items during the 8-week period following the issuance of the loan:

- Payroll costs, excluding prorated amounts for individuals w/ compensation > $100k

- Rent pursuant to a lease in force before February 15, 2020

- Electricity, gas, water, transportation, telephone, or interest expenses for services which began before February 15, 2020

- Group health insurance premiums and other healthcare costs

- But only if…

- The same number of employees are maintained based on specific guidelines1

- No employees with income under $100,000 have their salaries reduced by more than 25%

Application Process

- Lenders: At the outset, the PPP will be administered by the existing network of SBA-approved lenders

- Review & Approval: SBA has delegated authority to lenders themselves to make eligibility determinations without needing to go through SBA channels

- Loan Application: A description of the typical SBA loan process can be found here. However, the SBA may update the loan application process in an effort to reduce loan application and review timelines. Borrowers should refer to SBA.gov for the most current application information.

Employee Retention Credit

- New credit against payroll taxes

- 50% of wages paid to each employee, up to a maximum of $10,000 of wages per employee2

- Available to businesses with operations partially/fully suspended due to government-related suspension of operations; or that have a quarter with 50% less revenue (not profit) from the same quarter in 20193

Deferral of Payment of Payroll Taxes

- Employers will be permitted to defer 2020 payroll taxes

- 50% will be due on December 31, 2021

- Remaining 50% will be due on December 31, 2022

- Applies to self-employed individuals as well, but only the employer portion

Net Operating Loss (NOL) Rules Loosened

- Previously, NOLs could only be carried back 2 years or forward up to 20

- Tax Cuts & Jobs Act of 2017 changed rules beginning in 2018 to allow indefinite carry-forward

- CARES Act allows NOLs to be carried back up to 5 years

- Applies for 2018, 2019, or 2020 NOLs

- Accelerates a tax refund for current/immediate use

- NOLs will now be able to offset 100% of taxable income (up from 80%)

Small Business Administration Economic Injury Disaster Loan Program

Separate from the “CARE” Act, the SBA also offers a program (EIDL) for those impacted by a disaster:

- Up to $2 million per business

- Low-interest rates:

- 75% for small businesses

- 75% for non-profits

- May be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact

- Long-term repayments available up to a maximum of 30 years

- Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

So, you may be asking yourself, how does the CARES Paycheck Protection Act differ from the SBA’s Economic Injury Disaster Loan? Are there any similarities? Well, there are certainly some major differences but also many similar provisions. Please see below for more details:

Differences

- No personal or business collateral is required.

- The SBA disaster loan may require collateral for loan amounts over $25,000.

- It’s ok if you also have access to credit elsewhere.

- To receive a SBA disaster loan you generally need to have no other source of credit.

- The funding covers a more restrictive set of purposes

- The SBA disaster loan can cover most operating expenses.

- Your loan can be forgiven if you follow the terms.

- The SBA disaster loan requires repayment.

Similarities

- You need to demonstrate your business was economically affected by COVID-19.

- It’s free to apply.

- Your loan is long-term (maximum 10 years) and low-interest (maximum 4%).

- You have an extended deferment period (6-12 months, depending on your lender) before you begin repayment.

- There is no prepayment penalty.

You can apply online for a Disaster Loan here.

To contact the SBA’s Disaster Assistance Service Team:

- 1-800-659-2955

- disastercustomerservice@sba.gov

Please note: Borrowers cannot receive a PPP loan in addition to an Economic Injury Disaster Loan (EIDL) through the SBA for the same purposes. However, a borrower who has an EIDL loan unrelated to COVID-19 may apply for a PPP loan (with an option to refinance the EIDL loan into the PPP loan). The emergency EIDL grant award of up to $10,000 would be subtracted from the amount forgiven under the Paycheck Protection Program.

If you accept an EIDL loan, and you subsequently qualify for the PPP loan, you can re-finance the EIDL loan with the PPP loan.

Resources

https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

https://www.kitces.com/coronavirus-stimulus-bill-new-rules-planning-strategies-and-opportunities-presentation-handout-materials-supporting-information/

https://bench.co/blog/operations/paycheck-protection-program/

https://www.fenwick.com/Publications/Pages/CARES-Act-What-the-Paycheck-Protection-Program-Means-for-Startups-.aspx

Footnotes

1 Same number of employees from February 15, 2020 through June 30, 2020 as either: (a) During the same period in 2019; or (b) January 1, 2020 until February 15, 2020

2 For businesses with up to 100 employees, all wages are eligible (up to $10k/month). For businesses with more than 100 employees, only wages paid to individuals not providing services due to government shutdown or required revenue decline.

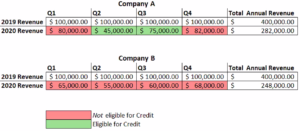

3 Example below: