Envisioning Your Perfect Retirement… Then Planning For It

Do you have a specific date marked on your calendar? Are you counting down the days until your retirement? You’ve planned for this moment for a long time now, but it’s just as important to plan for what’s ahead. Having the financial resources to retire is the first step but now you have to prepare for how you plan on enjoying it.

In a recent study1, researchers found that the majority of positive words and images people used to describe life after retirement correlated strongly with emotional values. In essence, people put a high degree of emphasis on emotional fulfillment in their retirement years.

With that in mind, what words would you use to describe your perfect vision of retirement?

Great! Now you’ve given some thought to what you want your retirement to look and feel like. But have you thought about how you’ll achieve it? What activities might fulfill you? Are there specific interests you’d like to pursue that you haven’t yet had a chance to?

If you haven’t considered these questions before, it’s crucial that you do so now… and then plan for it. This is because retirement researchers have found that a gap exists between what retirees say they want to do with their time vs what they actually do 2. Specifically, they found that retirees’ need to engage in active activities increased with age (and conversely, the need for passive activities decreased), but most retirees spent more time on the passive activities which actually resulted in a decrease in their overall happiness! Obviously, there is some sort of cognitive dissonance happening which is why, if we want to maximize our fulfillment in retirement, we shouldn’t just think about what we want to do. We should actually do it. And what is the best way to maximize the chance you’ll follow through on something? Write it down!

That’s why Andy McClaflin created the Retirement Adventure Roadmap.

Oftentimes, we find that when folks fully retire they aren’t prepared for the amount of free time at their disposal. For those that were incredibly passionate about their careers, they may even lose their sense of purpose. In fact, numerous studies have shown that early retirement may correspond with an increase in mortality. That is why it is imperative to continue to be as mentally and physically active as possible in retirement. The more retirees can engage in activities that are cognitively and physically stimulating, the better their outcomes, both from a mental and health perspective.

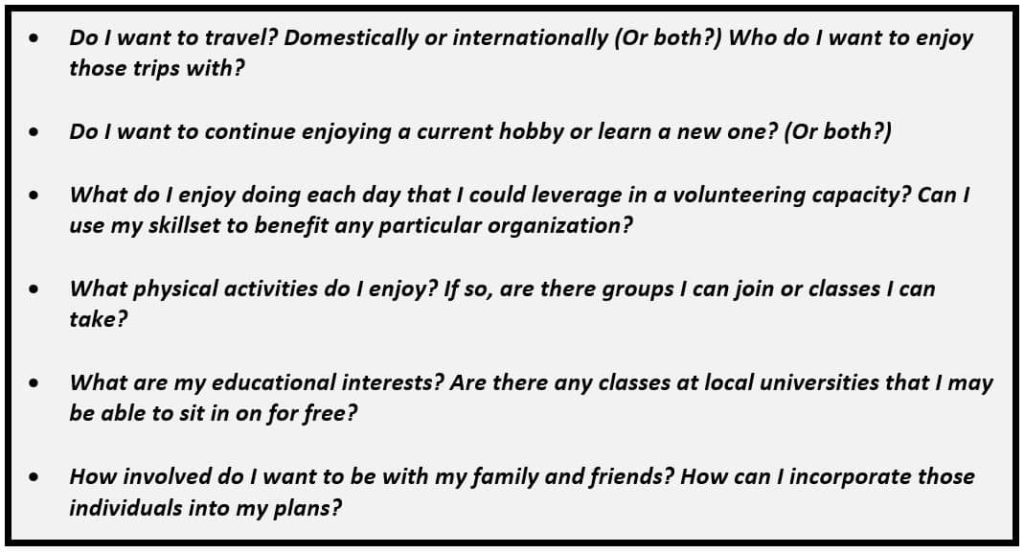

To help get you started thinking about what you might like to do, consider the following examples from the Roadmap:

Hopefully these questions provoke a renewed interest in your retirement planning – and cause you to ask yourself even more questions! Remember, if you have a game plan ahead of time, and you’re ready to hit the ground running, you will be setting yourself up to make the most out of your golden years.

If you’re interested in meeting with the team at Aspen Wealth Strategies to take a “test drive” with the Retirement Adventure Roadmap, and incorporate that into your overall financial plan, please see this link to contact us for a complimentary consultation. We hope to see you on the road to retirement soon!