Navigating Healthcare & Medicare Expenses in Retirement

Preparing for healthcare expenses in retirement can be a daunting task but educating yourself and having your financial plan stress-tested are critical first steps and ones that we want to help you with. While these expenses can no doubt be significant, pro-actively planning for them could result in much better outcomes and allow you to stay focused on your other retirement goals!

A Few Quick Statistics…

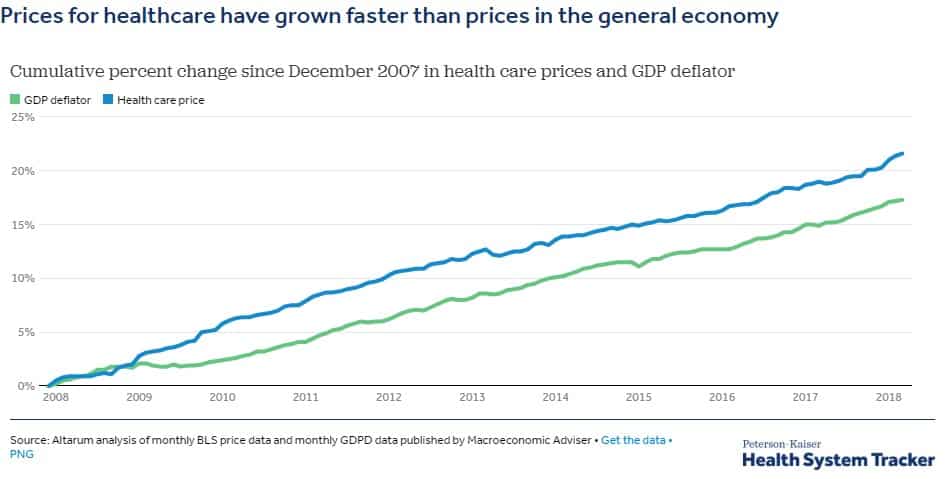

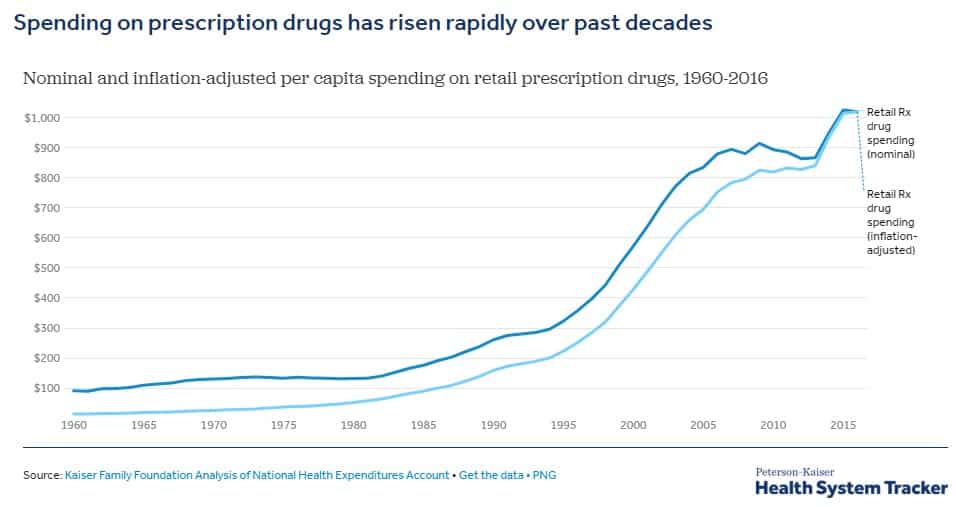

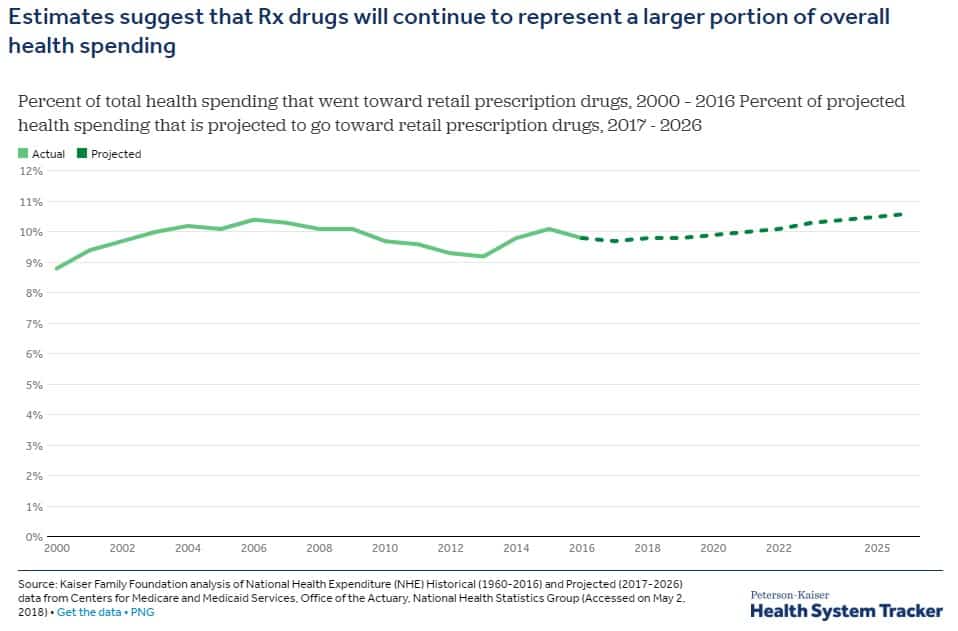

Before diving in, it’s important to understand where we are today, and where we might be in the future in regards to these expenses. In summary, and which is likely not a surprise to you: healthcare has outpaced inflation for the past decade with prescription drug costs leading the way. For example, a prescription that cost $100 ten years ago would cost roughly $120 today.

What the “Average” American Might Expect to Pay for Medicare

This is incredibly difficult to determine due to the specific needs and anticipated healthcare usage of each individual and couple, but the task is made much easier if we instead look for an average.

One of the foremost experts in the financial planning field, Michael Kitces, had this to say about these costs:

“Notwithstanding common fears of the magnitude and instability of health care costs in retirement, Medicare is actually remarkably effective at stabilizing the cost of medical expenses in retirement. Cumulatively, purchasing the ‘maximum’ coverage, including Part A, Part B, and Part D prescription drug plan, and Medigap supplemental insurance, costs almost $5,000/year (or $10,000/year for a couple). However, at that point, additional out-of-pocket costs are often no more than $1,000 – $3,000 per year, which makes the total cost of Medicare significant, but a ‘plannable’ expense.”

For our part, we have also run estimates of what an average American may expect to pay and the results were very much in-line with Michael’s:

For a single individual in Colorado:

+$187/month for Part B premiums (first surcharge tier)

+$74/month for Part D premiums

+$116/month for Plan G premiums

+$377/month or $4,524/year

+$1,500 annual out-of-pocket (OOP) costs

≈$6,000 total per year, per person

Other respected financial planners in the industry have estimated costs in range as well, with most estimating maximum costs for a married couple between $12,000-$13,000 if getting all the “bells and whistles.” Of course, these expenses will vary by person but can be a beneficial starting point.

Common Misconceptions

“Medicare covers everything” | False. Basic Medicare does not cover dental, vision, hearing, prescription drugs, overseas care, or deductibles and co-pays. Part D is specifically designed to cover prescription drugs, and Medicare Advantage plans may cover dental, vision, and hearing.

You can see if a particular test, item, or services is covered here.

“Medicare will cover LTC” | Medicare will not cover custodial care if that’s the only care someone needs (and which accounts for the majority of nursing home care). This type of care involves assistance with everyday tasks, often referred to as “Activities of Daily Living” or ADLs (i.e. dressing, bathing, etc.)

Medicare will cover the following “long-term care” services to varying degrees:

- Care in a long-term care hospital

- Skilled nursing care in a skilled nursing facility

- Eligible home health services

- Hospice & respite care

“I will be automatically enrolled”/“Medicare will notify me when I need to enroll” | False. You will either need to enroll when you turn age 65, or if working past that age, within eight months of retirement. If you miss the deadline, you will be subject to a permanent penalty equivalent to 10% more in premium cost for every 12 months you delay.

For individuals without coverage, it’s recommended to enroll as soon as you are eligible; this initial enrollment period is seven months and begins three months before your birth month. For example, if you were turning 65 in September of this year, your initial enrollment period would be June through December. It’s also beneficial to sign up as soon as you can (three months prior) so you don’t experience any delays in coverage.

If you plan on enrolling for Medicare Part D or Medicare Advantage, the annual open enrollment period runs from October 15th to December 7th.

“Medicare is going bankrupt” | False. Per the Social Security and Medicare Board of Trustees’ latest report, Medicare will exhaust its cash reserves by 2028 at which point the program would become a budget-neutral program. This means that money generated from payroll taxes will continue to be able to support benefit payments for enrollees. Instead, there will likely be a reduction in payouts to physicians and hospitals and therefore, the chance that some providers may decide to discontinue offering Medicare coverage.

“I can still use my HSA” | It depends. Once enrolled in Medicare, you can no longer contribute to an HSA but you are still able to take tax-free distributions for qualified expenses, including Medicare premiums.

Understanding the Differences Between Part A & B

Part A Services | Hospital insurance that covers the following:

- Inpatient hospital care

- Skilled nursing facility

- Hospice

- Lab tests

- Surgery

- Home health care

Part B Services | Medical insurance that covers the following:

- Outpatient care

- Preventative services

- Ambulance services

- Durable medical equipment

- Mental health services

Part A Premiums | Sometimes referred to as “premium-free Part A,” most individuals do not pay additional for Part A if they are eligible for, or are already receiving, Social Security retirement benefits. Essentially, these costs are covered by Medicare taxes paid during employment.

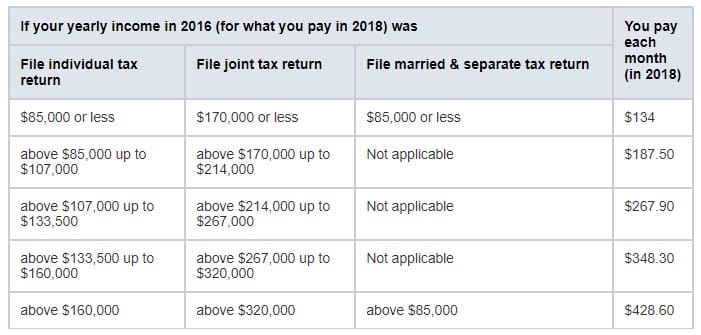

Part B Premiums | Part B premiums will be automatically deducted from Social Security benefits. The standard Part B premium for 2018 is $134 per month but can be higher for individuals whose Modified Adjusted Gross Income (MAGI) is above a certain amount. These premium adjustments are what are known as Related Monthly Adjustment Amounts (IRMAA) and are based on your MAGI from your IRS tax return from 2 years ago.

Below is a chart of these IRMAA, provided by Medicare.gov:

https://www.medicare.gov/your-medicare-costs/costs-at-a-glance/costs-at-glance.html#collapse-4809

Part D

These plans add drug coverage to 1) Medicare 2) Medicare Cost Plans 3) some Medicare Private Fee-for-Service plans, and 4) Medicare Medical Savings Account (MSA) plans. You can expect to pay the following under Part D:

- Premiums

- Annual deductible

- Co-payments or co-insurance

- Coverage gap (aka the “donut hole”) which is expected to close at the end of 2018

Medigap/Supplement Plans vs Medicare Advantage

Medigap/Supplement Plans | These plans are offered by private insurance companies and cover certain healthcare costs not covered by basic Medicare (i.e. premiums, copayments, and deductibles). Out of 50 states, 47 of them (excluding MA, MN, WI) have 10 standardized plans: A, B, C, D, F, G, K, L, M and N. It’s important to note that even those these plans are “standardized,” different companies can charge different amounts so out-of-pocket costs can vary for the same type of plan.

These plans don’t provide prescription drug coverage, so if this is something you’ll need, you’ll still have to enroll in Part D.

For those that have moderate to significant healthcare needs and have the financial capacity to pay the significantly higher premiums, Plans G & F can be a great choice because they cover nearly all coverage gaps and have minimal, or no, out-of-pocket costs.

Another advantage of Medigap plans is the broader coverage associated with these plans; you can see any doctor or go to any facility that accepts Medicare.

Medicare Advantage Plans | Also referred to as Medicare Part C, these plans provide coverage through Medicare-approved private insurance companies. Some of these plans may include additional benefits for services not otherwise covered, including vision, dental, and/or prescription drug coverage.

These are similar to private health insurance plans in that services such as lab work, office visits, and surgery are covered after a small co-pay. Depending on where you live, these plans can operate like an HMO or PPO and may require you see a specialist or shoulder additional costs for out-of-network care.

Even if enrolling in one of these plans, you will still be required to continue paying Part B premiums.

Which plan should you choose? | The answer to this question will depend upon several factors including your health care usage, need for certain prescription drugs, comfort level with restrictions on doctors, hospitals, and pharmacies, ability to absorb higher premiums, maximum out of pocket costs, etc.

Below are a few key differences that may help you better understand the trade-offs:

- Ability to use certain providers – Medicare Advantage normally limits who you can see and what facilities you can go to and will not normally cover out-of-network care. On the other hand, Medigap can be used at any facility that accepts Medicare.

- Availability of services – Medicare Advantage oftentimes will only operate within a certain geographic region so if you’re a frequent traveler, Medigap might better suit your lifestyle.

- Cost – Medigap is normally more expensive from a premium standpoint but with the inherent trade-off of potentially lower out-of-pocket expenses. For those on a tighter budget, Medicare Advantage may be the better option.

Enrollment Periods

General Enrollment Period | You can enroll for Part A and/or B between January 1st through March 31st if the following bothapply:

- You didn’t sign up when you first became eligible, and

- You are not eligible for Special Enrollment

Special Enrollment Period | Used if you were covered under a group health plan based on you (or a spouse’s) current employment. This enrollment lasts for eight months and the clock begins at the earlier of:

- The month after your employment ends, or

- The month after your group health insurance ends (note: COBRA and retiree coverage do not count!)

Obviously, the Medicare process and plan selection can be overwhelming but prior to making any decisions, please come speak to us so that we can review your options with you and analyze the impact of those options on your financial plan.

Interested in reading more?

- You can access additional financial planning articles, as well as market & economic updates, here.

- Have questions or want to set up a meeting? You can do so here.