Social Security Claiming Considerations

According to the Social Security Administration, nearly three-quarters of Americans choose to begin benefits prior to their full retirement age (FRA). Whether or not this is the right choice depends on a myriad of different factors which we will discuss below. Making an uninformed choice could cost you tens of thousands of dollars over your lifetime. With that in mind, prior to filing for benefits, it is wise to speak with a financial advisor who can tailor this analysis to your specific situation so that you can make the most financially advantageous choice.

How Your Social Security Benefit is Calculated

Average Indexed Monthly Earnings (AIME) | Social Security benefits are computed using AIME, which is a summary of a worker’s highest earning 35 years (if you have less than 35 years, your benefits will be reduced to account for those non-earning years). The Administration then applies a formula to the worker’s AIME to determine their Primary Insurance Amount or PIA. Essentially, this is the benefit a worker would receive if they waited to collect benefits until Full Retirement Age or FRA.

Contribution and benefit base | This is the amount of taxpayers’ earnings subject to Old Age, Survivors, and Disability Insurance (OASDI) taxation for any given year. For 2018, this base is $128,400 and is indexed annually to account for changes in the national average wage index. The OASDI tax rate is 12.4% total or 6.2% for both employees and employers. Therefore, for any individual that earns $128,400 or more in 2018 would owe $7,961.80 in OASDI taxes with their employer owing the same amount.

Factors That Will Affect Your Benefit

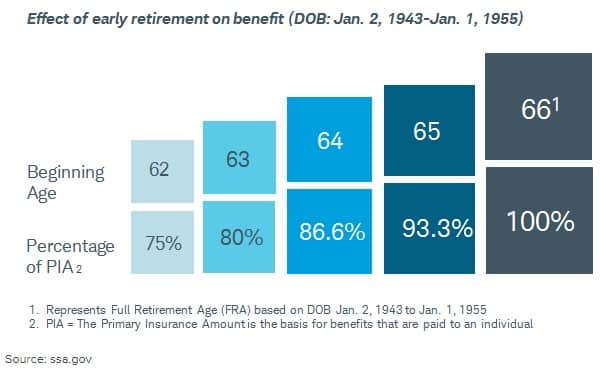

Early retirement | Individuals can begin receiving Social Security as early as age 62*, but benefits will be reduced for each month taken prior to FRA. In addition, individuals earning more than $17,040 per year while collecting benefits prior to FRA will have their benefits reduced further.

Full retirement age (FRA) | At FRA, you are eligible to receive your full Primary Insurance Amount or PIA. At this age, benefits will not be reduced if you are working.

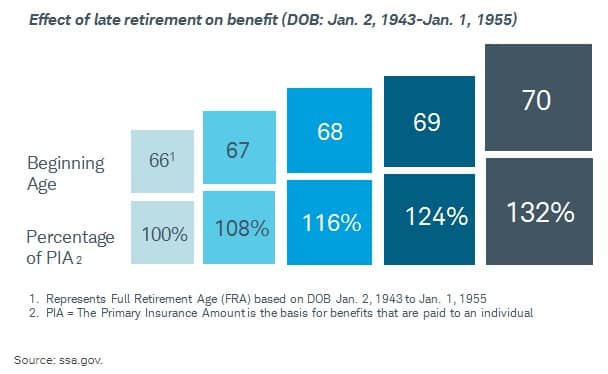

Delaying past FRA | For each year you delay past FRA, you receive an 8% increase in benefits. For example, if your FRA is 66 and you wait until age 70, your benefit would increase by 32%. Past FRA, you can work without any reduction in benefits.

You have certain government pensions | If you worked for a governmental organization that did not pay into Social Security, your benefits will be reduced accordingly.

For more information on determining your benefits and/or the extent of pension offsets, please visit ssa.gov.

*This age will continue to increase over time based on year of birth.

Increasing Your Benefits by Delaying

There are basically two different ways you can increase your benefit by delaying. First, as mentioned prior, for every year you delay past FRA you will receive an 8% increase in benefits. Second, if you’re working in a relatively higher-paying job than what you experienced earlier in your career and have already accumulated a 35-year work history, your higher-earning years will begin to replace your lower-earning years, thereby increasing your PIA.

Considerations

Social Security benefits were designed to be actuarially equivalent for an individual with an average life expectancy so, in theory, it shouldn’t make a difference when you start collecting. That being said, mortality obviously will vary from person to person, as will each individual’s investment returns, tax bracket, and personal spending inflation.

For someone deciding between taking Social Security as early as possible and waiting until FRA, or between FRA and age 70, the break-even point is somewhere in the mid-80s, depending on the aforementioned factors.

That being said, every situation is unique which is why you and your advisor should consider multiple different variables prior to making a decision.

Longevity | If we had a crystal ball and could pinpoint your exact life expectancy, we would have a much easier Social Security decision on our hands: if you were only going to live to your early 80s, we would tell you to file as soon as you can; if we knew you would live well past your 80s, we could tell you to delay until age 70. Of course, we haven’t developed a completely reliable crystal ball yet, so all we can do is make decisions based on the information available currently (and which is why financial planning and analysis is so important!)

Availability of other income/assets | This is essentially a two-part consideration. First, do you have other income sources that can sustain you while you delay benefits? For example, individuals with wages*, a pension, significant interest and dividends, or a significant investment portfolio relative to their needs may find it more mathematically beneficial to delay benefits since they don’t need to supplement as much of their income need from their portfolio. For folks that don’t have other significant sources of income, or whose portfolio cannot reasonably sustain the withdrawals necessary to supplement their lifestyle in the interim, would normally do better to claim as earlier.

The second consideration is related to the first in that, if someone is able to invest their benefits instead using them to meet spending needs, they can push the breakeven point out further and may actually benefit by claiming early (even when taking into account the benefits of delayed retirement credits).

Impact on the surviving spouse | If someone’ spouse’s financial security is highly dependent on the other, it may make sense to wait a bit longer before filing for benefits. Widow(er)s are entitled to 100% of the deceased spouse’s benefits at full retirement age but only up to the amount that the deceased spouse was receiving at the time. So, for example, if the deceased spouse claimed benefits early and was receiving $800 per month, the surviving spouse would receive $800 at their full retirement age. If instead, the deceased spouse waited longer to start benefits and was receiving $1,000 per month, that’s the benefit amount the surviving spouse would entitled to instead.

*Remember, if you are working and under FRA, your benefits may be reduced.

Recent Changes to Social Security Claiming Strategies

The Bipartisan Budget Act of 2015 closed two popular, albeit complex, strategies that were frequently used by married couples to maximize their benefits. Why the change? Spousal benefits were originally intended to only be paid to the extent they exceeded the benefit that the spouse earned based on their own record but… had essentially morphed into an advantageous loophole. Per the Social Security Administration, this change “preserves the fairness of the incentives to delay, but it means that you cannot receive one type of benefit while at the same time earning a bonus for delaying the other benefit.”

File & Suspend | Prior to April 30, 2016, one spouse could file and “suspend” their benefits (at or after full retirement age) so that their spouse could collect spousal benefits while the original spouse let their own benefit continue to accrue via delayed retirement credits. Under the new law, any time an individual delays, all benefits based on their record are suspended (not just their own).

Restricted Application | For those born on or after January 2, 1954, the restricted application strategy is no longer available. Basically, this loophole allowed people to “restrict” their application to only one type of benefit, i.e. at full retirement age, you could restrict your application to spousal benefits while letting your own retirement benefit continue to grow via delayed retirement credits.

Please feel free to reach out to us as Aspen Wealth Strategies if you’re nearing Social Security age; our incredibly robust financial planning software can help us determine, and illustrate for you, the most financially advantageous claiming strategy.